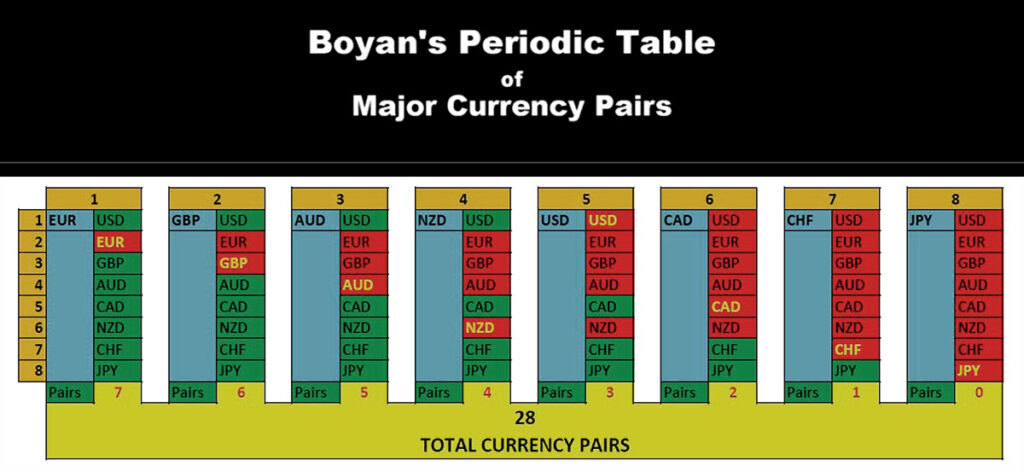

Major Cureency Pairs Traded

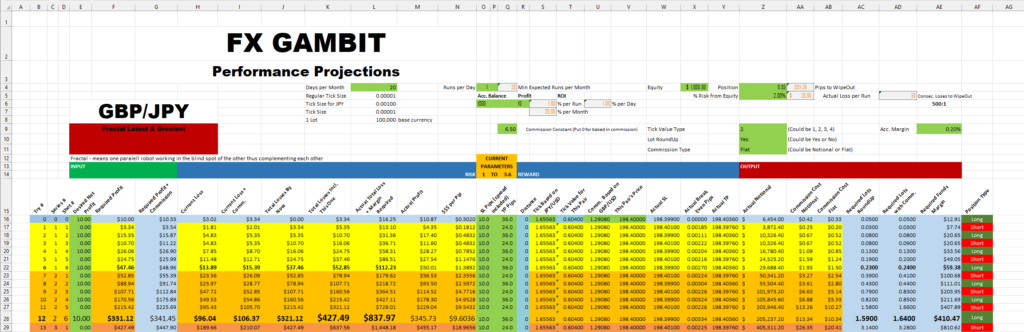

Road Map to Profit/Loss Projections

What If Scenarios

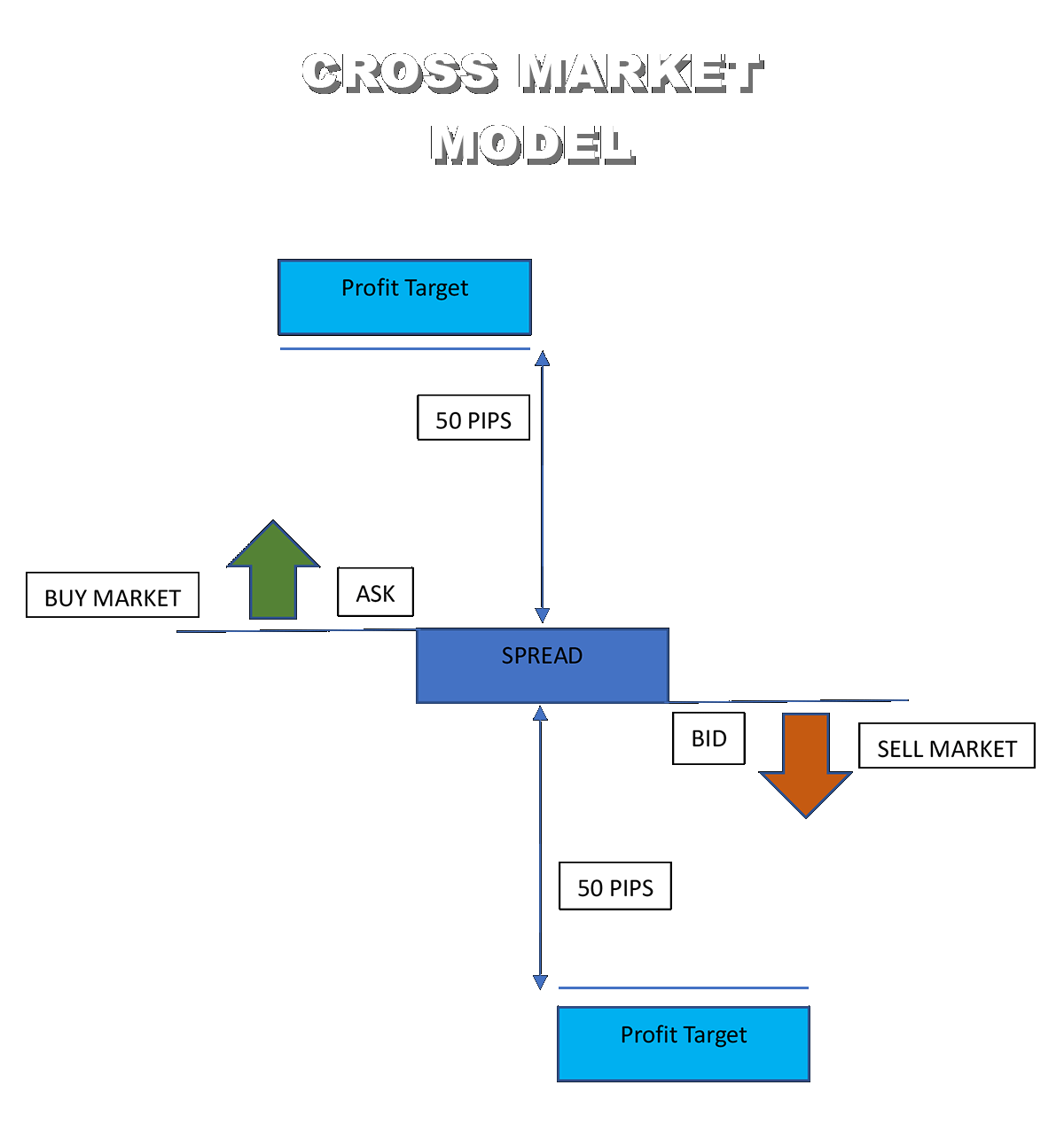

TRADING MODELS

1

- Cross Market Model – Two parallel MetaTrader4 with two robots each (one in each Chart), enter at the same time at the same Spread, as Market Orders. The robot’s Market Buy Order is entered at the current Ask, and the robot’s Market Sell Order is entered at the current Bid. This ensures profit in the next 50 pip market movement, both up and down. In fact, there is no situation in which one of the two robots does not make a profit, and the reciprocal one ends up breaking even at a zero loss.

2

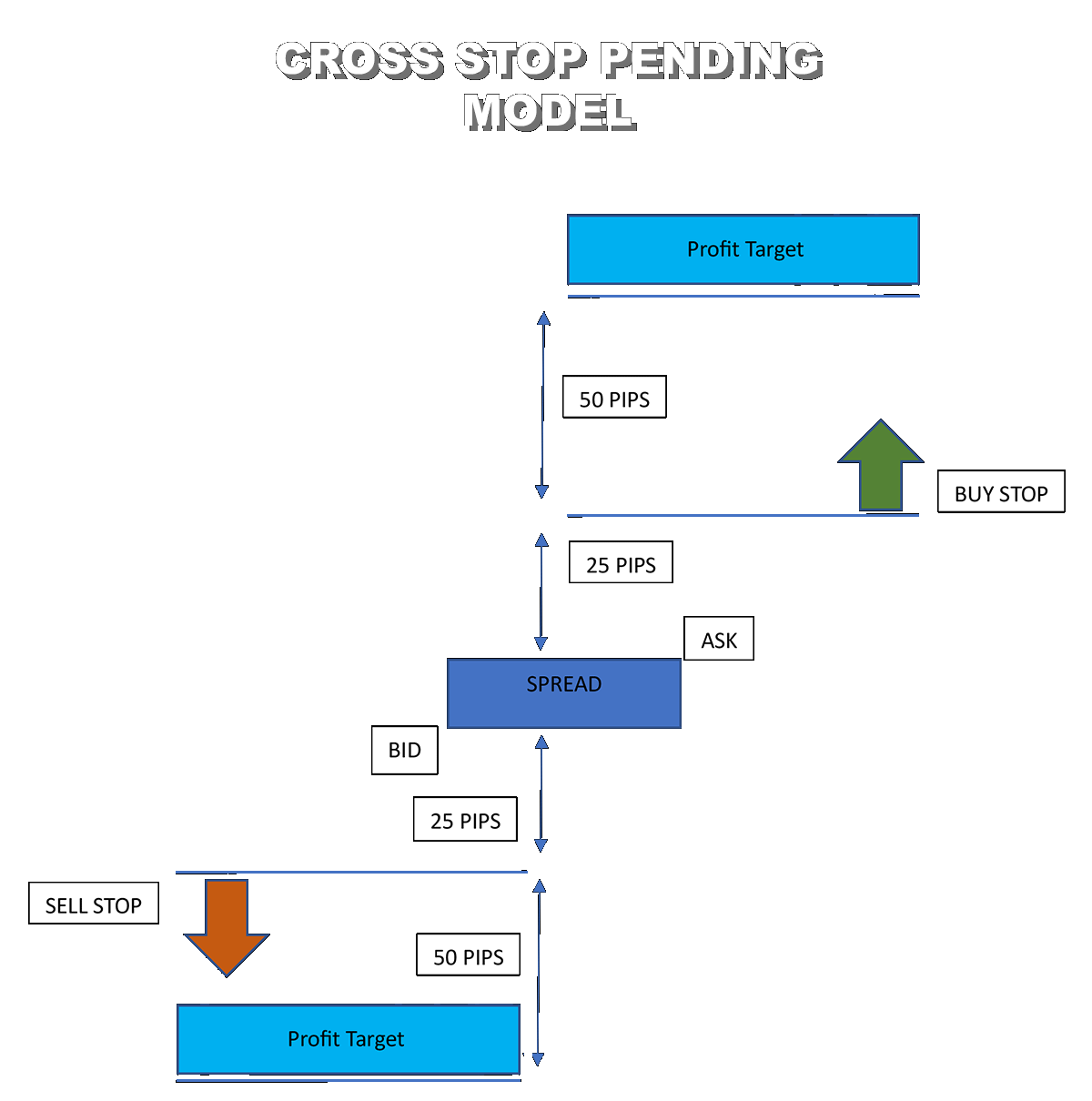

2. Cross Buy Stop/Sell Stop Pending Model – Two parallel MetaTrader4 with two robots each (one in each Chart), enter at the same time as two separate pending orders at the specified number of pips above and below the current Spread/Market. In this way, the robot’s Pending Buy Stop Order will be executed and converted into a Market Order when the current Spread reaches the level at which it is set (above the current Spread) and will be executed at the Ask of the future Spread. At the same time, the robot’s Pending Sell Stop Order will be executed and converted into a Market Order when the current Spread reaches the level at which it is set (below the current Spread) and will be executed at the Bid of the future Spread.

3

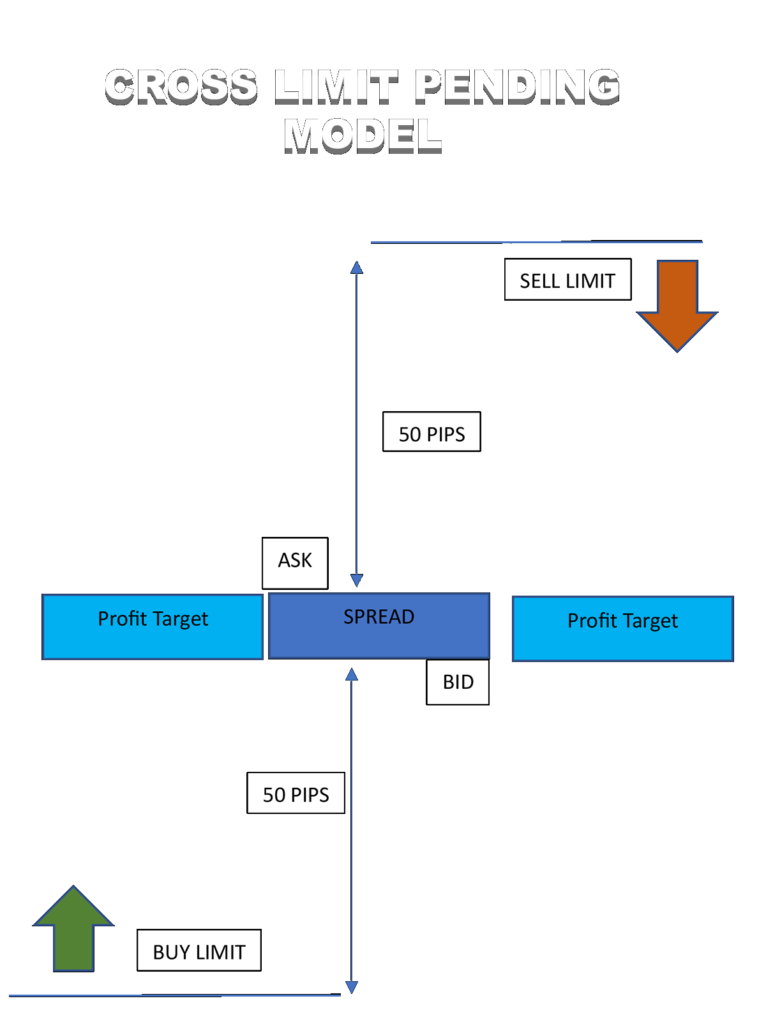

3. Cross Buy Limit/Sell Limit Pending Model – Two parallel MetaTrader4 with two robots each (one in each Chart), enter at the same time at a certain number of pips above and below the current Spread/Market. In this way, the robot’s Pending Sell Limit Order will be executed and converted into a Market Order when the current Spread reaches the level at which it is set (above the current Spread) and will be executed at the Bid of the future Spread. At the same time, the robot’s Pending Buy Limit Order will be executed and converted into a Market Order when the current Spread reaches the level at which it is set (below the current Spread) and will be executed at the Ask of the future Spread.

4

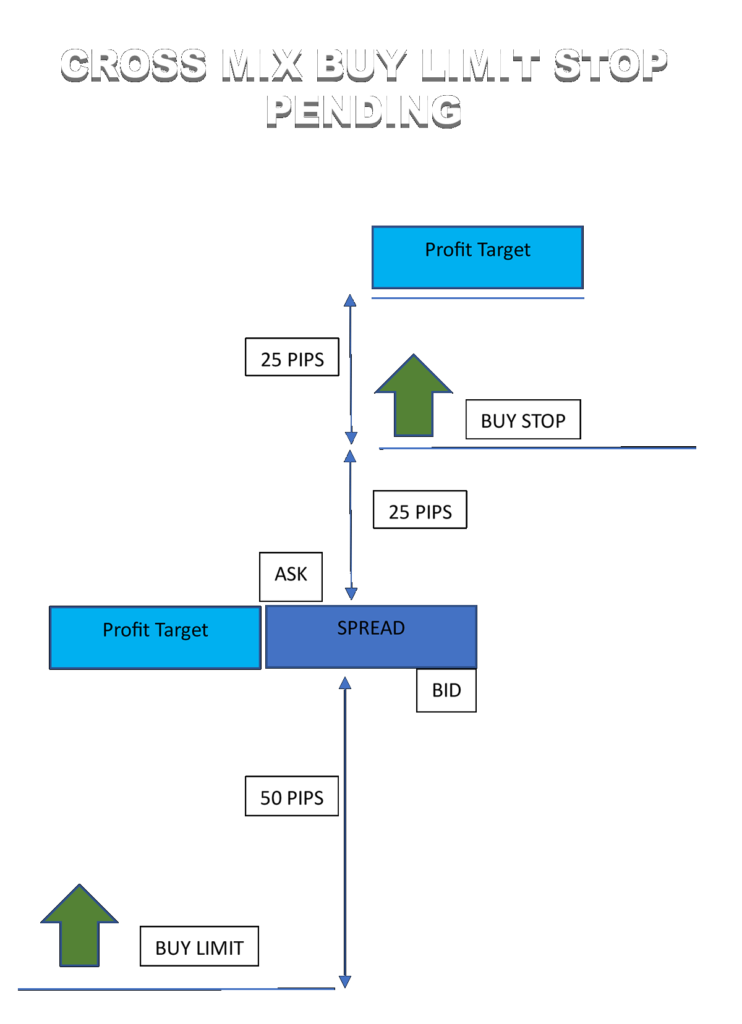

4. Cross Mix Buy Limit/Buy Stop Pending Model – Two parallel MetaTrader4 with two robots each (one in each Chart), enter simultaneously at the same time at a specified number of pips above and below the current Spread/Market. In this way, the robot’s Pending Buy Stop Order will be executed and converted into a Market Order when the current Spread reaches the level at which it is set (above the current Spread) and will be executed at the Ask of the future Spread. At the same time, the robot’s Pending Buy Limit Order will be executed and converted into a Market Order when the current Spread reaches the level at which it is set (below the current Spread) and will be executed at the Ask of the future Spread.

5

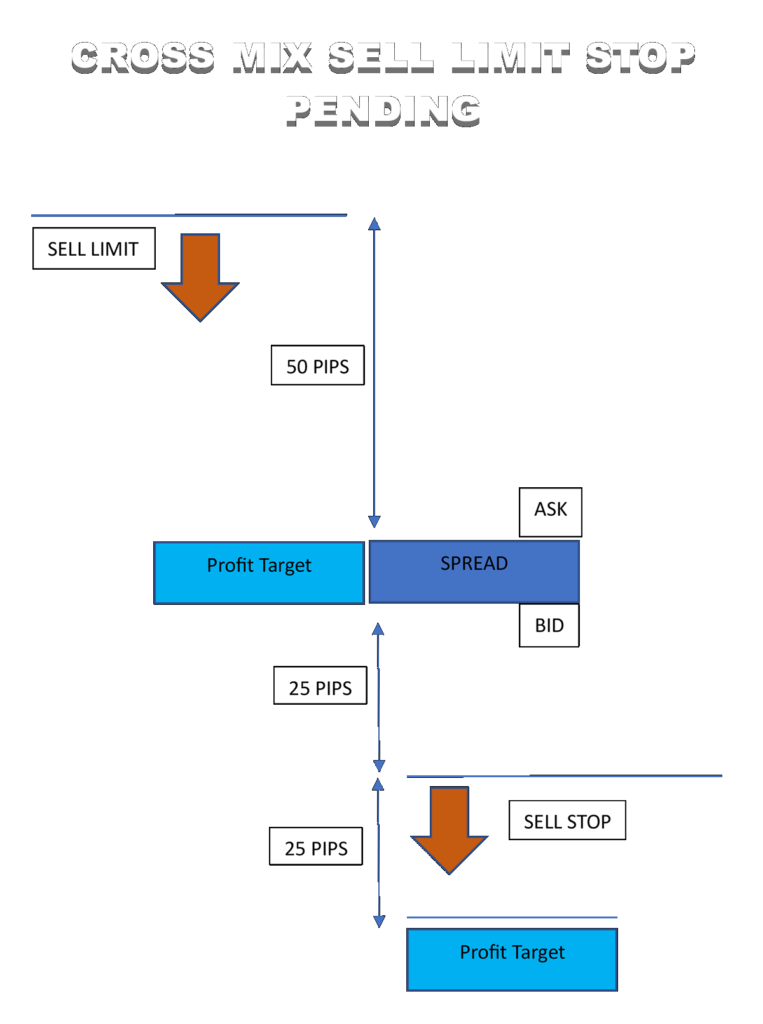

5. Cross Mix Sell Limit/Sell Stop Pending Model – Two parallel MetaTrader4 with two robots each (one in each Chart), enter simultaneously at the same time at a specified number of pips above and below the current Spread/Market. In this way, the robot’s Pending Sell Limit Order will be executed and converted into a Market Order when the current Spread reaches the level at which it is set (above the current Spread) and will be executed at the Bid of the future Spread. At the same time, the robot’s Pending Sell Stop Order will be executed and converted into a Market Order when the current Spread reaches the level at which it is set (below the current Spread) and will be executed at the Bid of the future Spread.

6

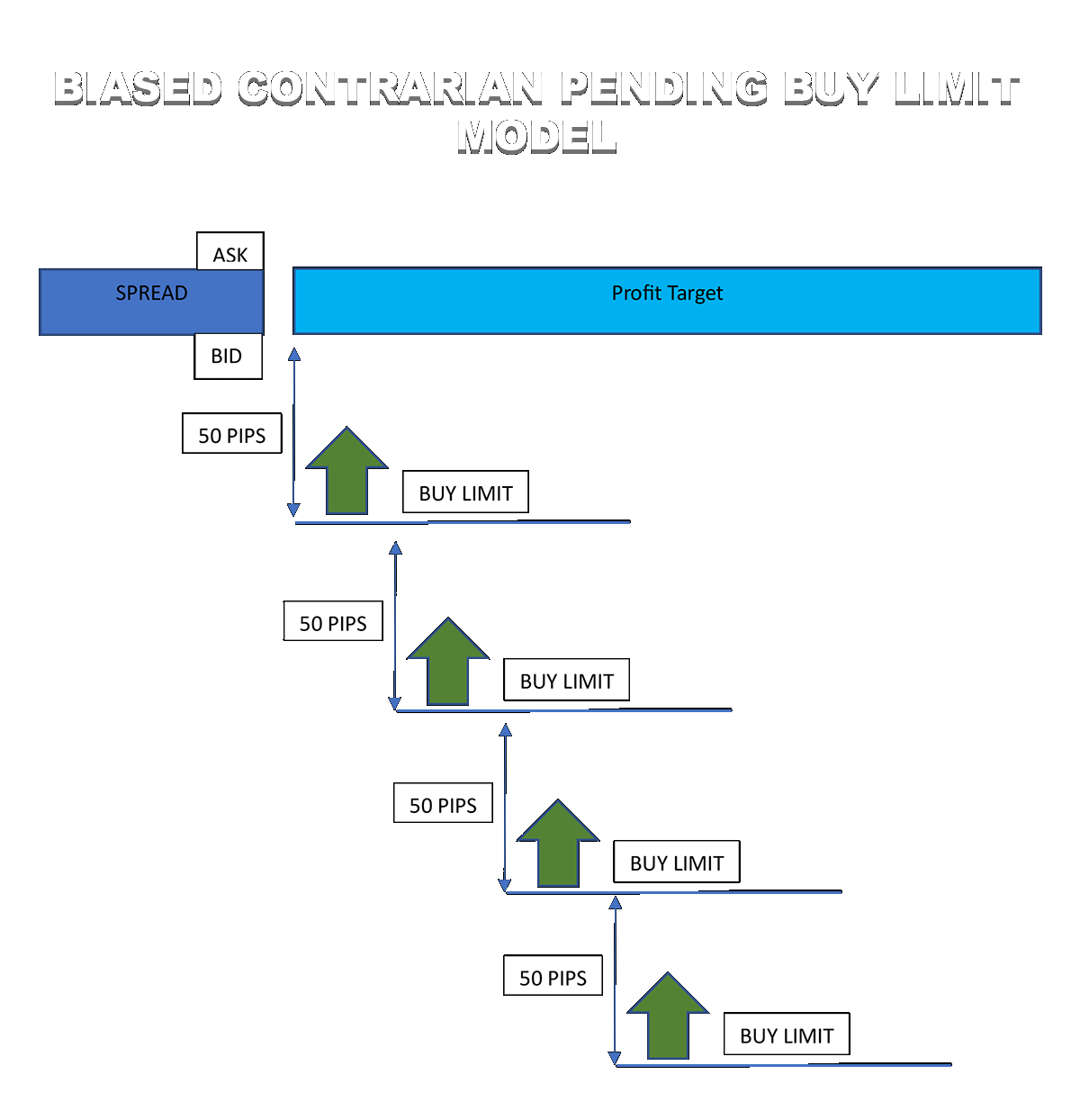

6. Biased Contrarian Buy Limit Pending Model – A MetaTrader4 with 4 robots (one in each Chart) successively position themselves below each other a certain number of pips below the current Spread/Market so that the entry of each subsequent Pending Limit Order matches or is slightly above or slightly below the Stop of the previous Pending Order. Thus, the robot’s Pending Buy Limit Order will be executed and converted into a Market Order when the current Spread reaches the level that it is set at (below the current Spread) and will be executed at the Ask of the future Spread. Thus, a series of Pending Orders is created only on the opposite side of the market. It is used in case we are convinced that we are in a major Up Trend and that the momentary fall is only a Retracement and not a major Reversal of the main Trend.

7

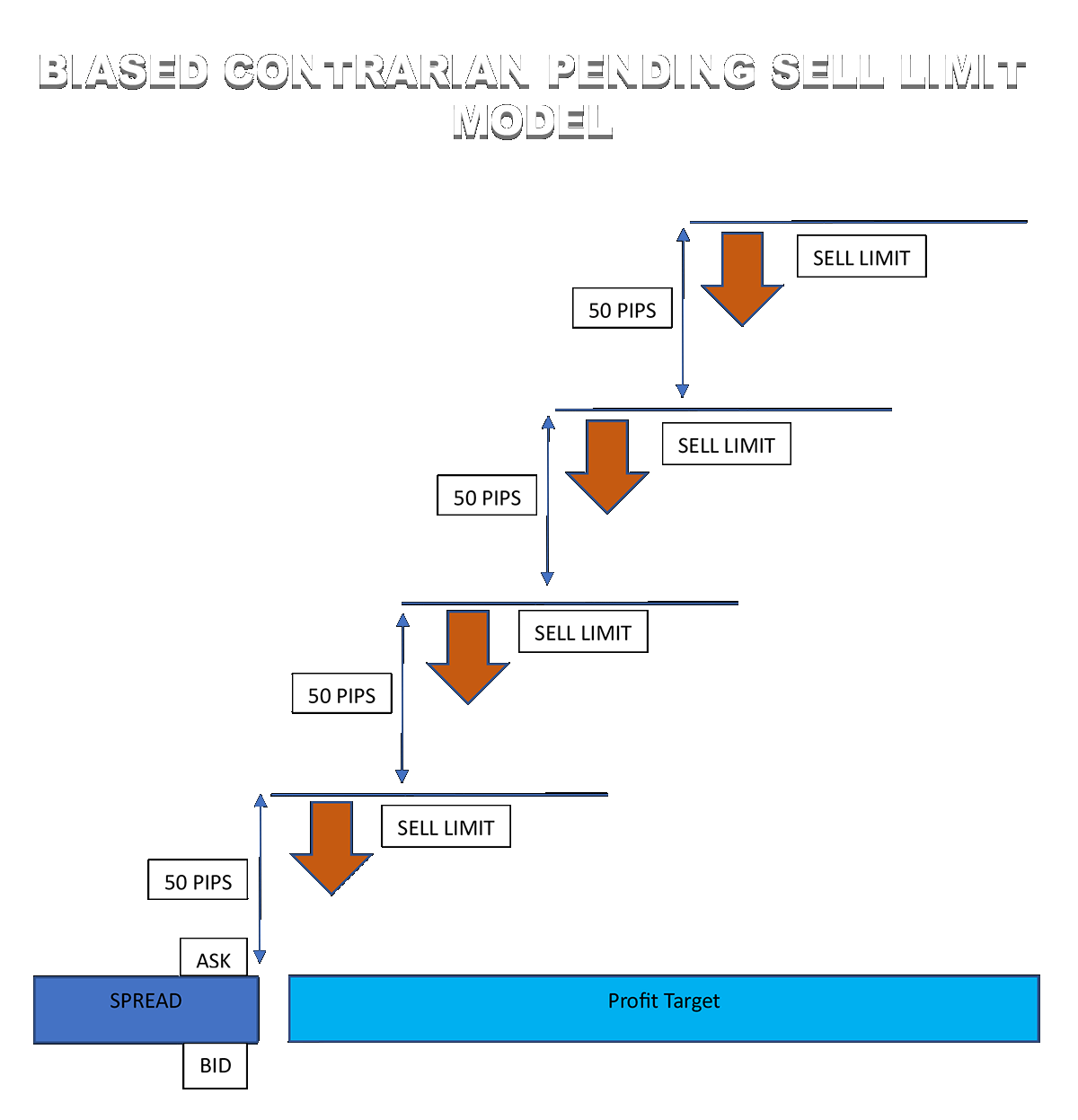

7. Biased Contrarian Sell Limit Pending Model – A MetaTrader4 with 4 robots (one in each Chart) successively positioned above each other at a certain number of pips above the current Spread/Market so that the entry of each subsequent Pending Sell Limit Order matches or is slightly above or slightly below the Stop of the previous Pending Order. In this way, the robot’s Pending Sell Limit Order will be executed and converted into a Market Order when the current Spread reaches the level at which it is set (above the current spread) and will be executed at the Bid of the future Spread. Thus, a series of Pending Orders is created only on the opposite side of the market. It is used in case we are convinced that we are in a major Down Trend and that the momentary rise is only a Retracement and not a major Reversal of the main Trend.